- (866) 299-9944

- Mon → Fri: 9am - 5pm

- Email: insight@mcculleyfinancial.com

Your Path to Financial Freedom and Brighter Tomorrows Begins Here!

The McCulley 401K is a streamlined retirement savings plan designed for simplicity and effectiveness. With diverse investment options and personalized guidance, it empowers individuals to build a secure financial future. Its flexibility allows for customized portfolio management, ensuring a dynamic and informed approach to retirement planning.

Unlock the right strategy and tools to amplify your savings with our Diverse 401k Solutions. Tailored for self-employed entrepreneurs, our approach opens doors to new opportunities, accelerating the growth of your nest egg. This includes identifying strategic methods to shield assets from taxes and reduce your overall tax liability, ensuring that you keep more of what you earn.

Picture the peace of mind that comes with knowing you can maintain your desired lifestyle throughout retirement. Our solutions go beyond mere financial planning; they empower you to stay prepared for the unexpected twists that life may bring. We understand the importance of leaving a lasting legacy for your loved ones, and our comprehensive 401k options are designed to align with your aspirations.

At Diverse 401k Solutions, we believe in providing not just a financial plan, but a roadmap to your future. Let us guide you through a diverse range of options, so you can confidently navigate the path to financial success, security, and a legacy that endures.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand. Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible. We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

The Hybrid 401(k) offers the same features and services as the 401(k), yet it provides you with a semi-open-architecture investment platform. With more than 200 investment options to choose from, this 401(k) plan is suitable for clients who want more choice and flexibility than the 401(k) offers.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio. Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning commission. Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

The Custom 401(k) gives you the ability to offer a fully customizable 401(k) for clients with at least 25 participants and $1 million in plan assets. Many 401(k) plans in the market offer flexibility in just the investment portfolio available to clients.

With the Custom 401(k), fun flexibility is just the beginning. You also get an open architecture plan design strategy that features a wide choice of 401(k) plan features you can select on an a la carte basis, including investment selection and advisory services, plan management, participant communication and education services, and compliance services.

The Auto-Pilot 401(k) was built exclusively for startup plans to meet plan sponsors concerns about affordability, simplicity, and how quickly a retirement plan can be implemented. The investment options are based on your choice of the several premier 401(k) platforms. Participant and plan sponsor services are also available to help make the plan successful

Explore our 401k services tailored for both individuals and businesses. We believe in simplifying retirement planning. Whether you’re new to investing or experienced, our approach is straightforward. We offer various options and personalized strategies to help you build a secure financial future. Our goal is to empower you to make informed decisions and achieve your retirement dreams.

We get what entrepreneurs need. Our support is personalized to tackle challenges and fuel growth. Simple, effective solutions for success.

Plan your money wisely with Comprehensive Financial Planning. Secure your future, grow wealth, and make smart investment choices for success.

Follow the best practices for managing money responsibly and ethically to build trust, be transparent, and achieve positive results for everyone.

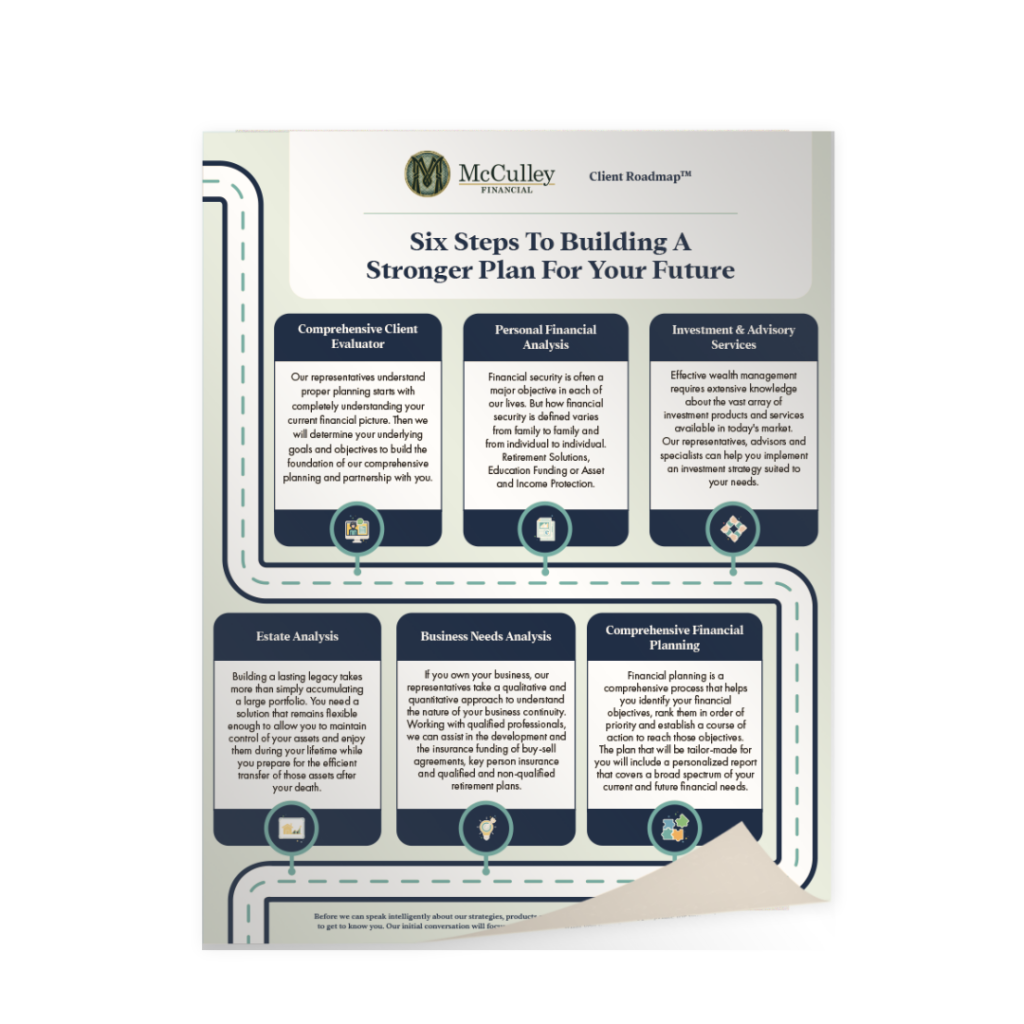

Download the Client Road Map™ PDF brochure below for a reference guide to our Financial Services.

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.