- (866) 299-9944

- Mon → Fri: 9am - 5pm

- Email: insight@mcculleyfinancial.com

Now is the time to create a legacy that’s clear and inspiring—no need to put it off until life gets complicated. Waiting only adds emotional weight to the process, making it harder to think clearly.

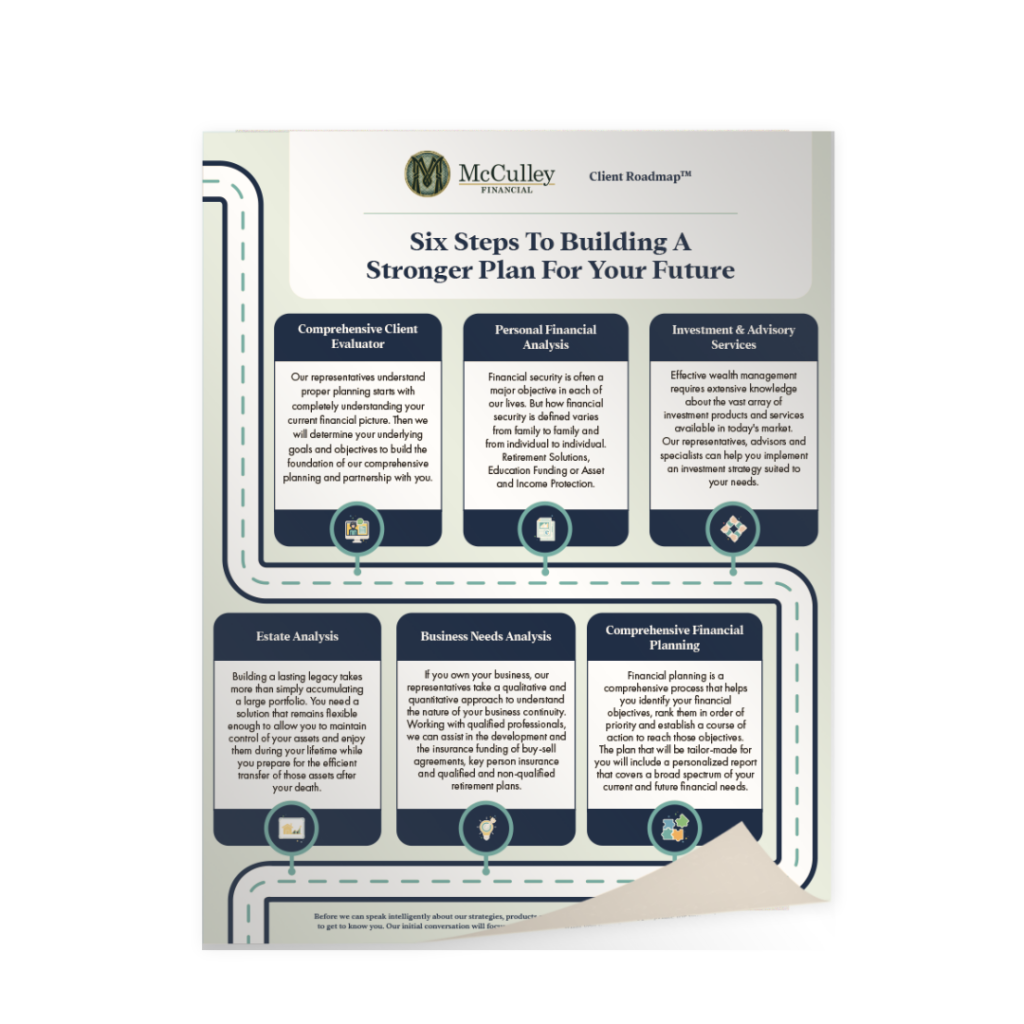

We get it; legacy planning can be overwhelming. But we’re here to make it simple. Take the first step by grabbing our free Client Road Map—it’s not your typical paperwork. Think of it more as your guide to brainstorming and understanding the basics of legacy planning.

Why wait for the “perfect” moment? Our Road Map is designed to take away the stress. It’s like your friendly companion, making legacy planning as easy as a Sunday stroll. So, what are you waiting for? Let’s get started, shape your legacy, and make it uniquely yours!

At McCulley Financial Group, we understand that the things you share with your loved ones go beyond money. We believe that the non-financial, often intangible gifts hold more value. These are the priceless treasures that future generations will hold dear, adding depth and meaning to their lives. We recognize that true wealth isn’t just about financial assets; it’s about the lasting legacy of love, memories, and the intangible qualities that shape a family’s story. We believe in creating an impact that goes beyond finances, fostering a rich tapestry of experiences and values that will resonate through time, creating a meaningful and enduring heritage for your loved ones. At McCulley Financial Group, our commitment is to help you navigate towards a legacy that goes beyond money, crafting a story of enduring significance that will shape the narrative for generations to come.

Prepare for the unexpected, and enjoy the tranquility of mind that comes with safeguarding your loved ones from potential chaos. Your legacy plan isn’t just a collection of documents; it’s a roadmap filled with wisdom and love.

Imagine the peace that washes over you, knowing that your invaluable guidance and cherished words will be seamlessly passed on to those you hold dear. Creating your legacy plan isn’t just about organizing paperwork; it’s a journey of self-discovery. Uncover what truly matters to you and how you want to leave your mark on the world.

As you craft this unique roadmap, feel the surge of pride knowing that you’re not just preserving traditions, but creating a lasting legacy for generations to come. Your story, your values, and your wisdom will become a beacon guiding your loved ones through the tapestry of life.

Don’t let uncertainty linger; embrace the empowering process of legacy planning. It’s more than just securing the future; it’s about leaving a legacy that echoes with the heartbeat of your essence. Let your story resonate for generations, turning moments into memories and guidance into a lasting gift. Prepare today, thrive tomorrow, and ensure your legacy becomes a timeless source of inspiration for those who matter most.

Prepare for the unexpected, and enjoy the tranquility of mind that comes with safeguarding your loved ones from potential chaos. Your legacy plan isn’t just a collection of documents; it’s a roadmap filled with wisdom and love.

Imagine the peace that washes over you, knowing that your invaluable guidance and cherished words will be seamlessly passed on to those you hold dear. Creating your legacy plan isn’t just about organizing paperwork; it’s a journey of self-discovery. Uncover what truly matters to you and how you want to leave your mark on the world.

As you craft this unique roadmap, feel the surge of pride knowing that you’re not just preserving traditions, but creating a lasting legacy for generations to come. Your story, your values, and your wisdom will become a beacon guiding your loved ones through the tapestry of life.

Don’t let uncertainty linger; embrace the empowering process of legacy planning. It’s more than just securing the future; it’s about leaving a legacy that echoes with the heartbeat of your essence. Let your story resonate for generations, turning moments into memories and guidance into a lasting gift. Prepare today, thrive tomorrow, and ensure your legacy becomes a timeless source of inspiration for those who matter most.

We get what entrepreneurs need. Our support is personalized to tackle challenges and fuel growth. Simple, effective solutions for success.

Plan your money wisely with Comprehensive Financial Planning. Secure your future, grow wealth, and make smart investment choices for success.

Follow the best practices for managing money responsibly and ethically to build trust, be transparent, and achieve positive results for everyone.

Download the Client Road Map™ PDF brochure below for a reference guide to our Financial Services.

Feel free to chat with us! We’re all ears and excited to hear from you.

©2024 McCulley Companies

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.