2018 Goals

Happy New Year! As one year ends and another begins, it’s interesting to think about what goals you have and have not accomplished. Sometimes we achieve all of the goals

Happy New Year! As one year ends and another begins, it’s interesting to think about what goals you have and have not accomplished. Sometimes we achieve all of the goals

This week, I want to discuss the importance of accountability. As I mentioned last in my last post, when it comes to your goals for this year, you should be

“How much should I be saving for retirement? Is there a certain percentage of my income that I should be saving?” These are questions that I am asked frequently. The

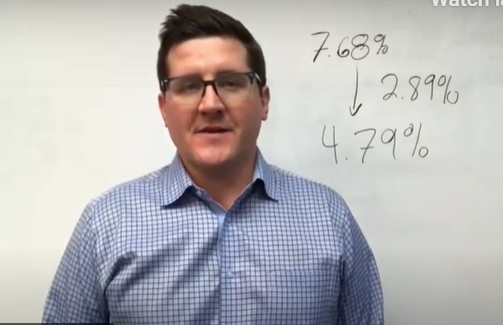

The market rises and the market falls- it will never be perfectly consistent. Based on research for the Dalbar study, it was discovered that there is a significant gap between the

With this weeks topic being the importance of financial plans, I wanted to share with you this study that was done in June of 2016. The Vanguard Alpha Study discusses what is helping

There’s a famous quote that says,”If you want to go fast, go alone. If you want to go far, go together.” Many people have no problem doing things on their

When the new tax law was first revealed, many were quick to bash any negative aspects of it that they could find. To start this week off, I wanted to

Personally, I don’t think this is a question. To me, this is a fact: retirement is dead. Let me explain: Nowadays, people are living longer, which means the length of

Being a corporate pilot comes with many perks. You get to travel to countries most people only dream of, meet interesting people from all over the world, and earn a

Investing in farmland has been growing in popularity among those looking for a stable and long-term investment opportunity. This investment opportunity may sound strange to you if you’re not familiar

Feel free to chat with us! We’re all ears and excited to hear from you.

©2024 McCulley Companies

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.