- (866) 299-9944

- Mon → Fri: 9am - 5pm

- Email: insight@mcculleyfinancial.com

In a world where financial decisions shape our future, having a guide becomes crucial. People seek choices, confidence, and opportunities for a secure tomorrow, while employers aim to improve loyalty, performance, and overall results.

McCulley Financial Group is here as your partner in legacy planning. Our dedicated financial planning experts are available to plan participants at no cost. We value confidentiality, providing a private and trustworthy space for your financial journey.

Sit down with our licensed professionals for a thorough review. Explore personalized analyses covering retirement and non-retirement assets, investment choices, asset protection, 529 college planning, IRA rollovers, investment diversification, and life insurance. It’s not just about planning; it’s about shaping your legacy with ease and confidence. Your future begins now.

Embarking on the road to program success is like plotting a journey where simplicity is our map and collaboration is our compass. Imagine sculpting a vision that’s uniquely yours, guided by a plan as sturdy as a fortress, ensuring a future filled with promise.

Our commitment goes beyond the dull drum of financial talk; it’s about making moves that create ripples of real value and confidence. We’re not just crunching numbers; we’re building a connection with you based on trust, straightforward steps, and results you can see and touch.

In the dance between organizational triumph and personal growth, we’re here to choreograph the perfect routine. Our process ensures that your efforts to support your team seamlessly blend with your own aspirations. Think of it like orchestrating success where both the team and leadership hit the high notes together.

Imagine joining us on a journey where strategic planning effortlessly aligns with your unique ambitions. The path to program success is not a dull commute; it’s a thrilling ride where thoughtful planning meets exciting actions. Together, we’re not just scripting success; we’re composing a symphony of accomplishments and pure satisfaction.

In a nutshell, our approach is like launching a rocket towards success – a future sculpted around your dreams, with a clear and secure plan. Through intentional moves and a shared adventure, we’re not just chasing success; we’re creating a narrative of enduring triumphs, personally and for your organization. So, let’s buckle up – we’re steering towards a future where your success takes center stage!

We find inspiration in national averages, prompting us to seek positive change. Understanding current norms fuels our commitment to collective improvement, fostering a more prosperous and equitable future.

Collectively, we share a meaningful duty—to help employees save for retirement and invest in their futures through accessible education. Our commitment goes beyond instruction, aiming to nurture a culture that values and prioritizes everyone’s long-term financial well-being. Together, we work towards creating an environment where employees not only build wealth but also gain the knowledge and confidence to navigate their financial paths successfully.

We get what entrepreneurs need. Our support is personalized to tackle challenges and fuel growth. Simple, effective solutions for success.

Plan your money wisely with Comprehensive Financial Planning. Secure your future, grow wealth, and make smart investment choices for success.

Follow the best practices for managing money responsibly and ethically to build trust, be transparent, and achieve positive results for everyone.

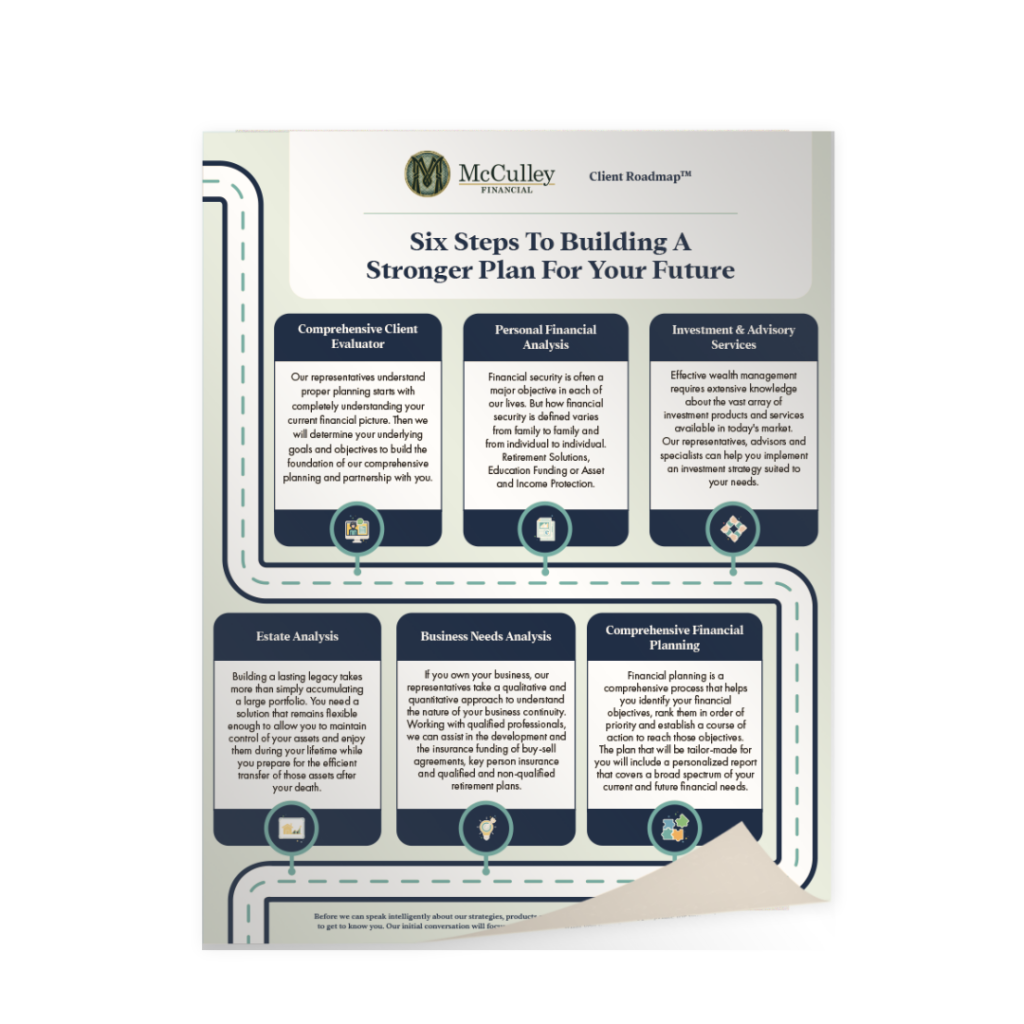

Download the Client Road Map™ PDF brochure below for a reference guide to our Financial Services.

Feel free to chat with us! We’re all ears and excited to hear from you.

©2024 McCulley Companies

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.