- (866) 299-9944

- Mon → Fri: 9am - 5pm

- Email: insight@mcculleyfinancial.com

How We Make 401k Work for You and Your Team – Simple, Smart, and Stress-Free Services

At McCulley Financial Group, we simplify corporate retirement planning. We’re not just about plans; we’re about worry-free solutions. Whether it’s a benefit or contribution plan, our independent approach ensures a custom strategy for employees. We focus on more than just investments, prioritizing a straightforward design and processes for easy retirement planning. Our services cover everything you need:

Helping Participants:

At McCulley Financial, we provide extra help for your employees. We partner with you to create a retirement plan and offer personalized guidance, supporting your employees as they move from their careers to retirement.

Understanding Your Plan:

We begin by gathering information about your plan to determine the goals for your company’s Education Experience. This involves looking at participation rates, deferral rates, investment choices, and loan behavior, among other factors.

We take a close look at your employees and how they interact with the plan, uncovering any specific issues. We conduct surveys to understand how well they grasp the plan and how satisfied they are with it. Our aim is to understand your employees’ needs and expectations so that the retirement plan can better meet their requirements. By addressing challenges and concerns early on, we ensure the plan is effective and meets the satisfaction of your employees.

Now, let’s plan the next steps for your program. We’ll work on increasing involvement, saving more, diversifying investments, understanding loan impacts, balancing, addressing terminations, and keeping you informed about any changes. Together, we’ll make sure your plan fits your needs and goals.

We believe in communicating in a way that suits everyone. By dividing employees into different groups, we can share messages that matter most to each. For instance, we’ll focus on welcoming new and nonparticipating employees, highlight the benefits of increasing contributions for those with low rates, offer guidance on managing loans, and provide tailored retirement planning information for those aged 55 and older. This way, everyone gets information that’s useful and relevant to them.

We approach 401(k) education in a fun and memorable way, aiming for noticeable results. We believe learning should be enjoyable, and your active involvement is crucial! Join us on this engaging journey toward financial empowerment and knowledge retention. Because when it comes to securing your financial future, staying engaged makes all the difference!

We’ll set up regular employee meetings – every three months, every six months, and yearly. In these meetings, we’ll cover specific topics, outline actions to take, and consistently review the results. This ongoing process is designed to keep things clear, address issues effectively, and make sure we’re always moving towards our goals.

Explore our 401k services tailored for both individuals and businesses. We believe in simplifying retirement planning. Whether you’re new to investing or experienced, our approach is straightforward. We offer various options and personalized strategies to help you build a secure financial future. Our goal is to empower you to make informed decisions and achieve your retirement dreams.

We get what entrepreneurs need. Our support is personalized to tackle challenges and fuel growth. Simple, effective solutions for success.

Plan your money wisely with Comprehensive Financial Planning. Secure your future, grow wealth, and make smart investment choices for success.

Follow the best practices for managing money responsibly and ethically to build trust, be transparent, and achieve positive results for everyone.

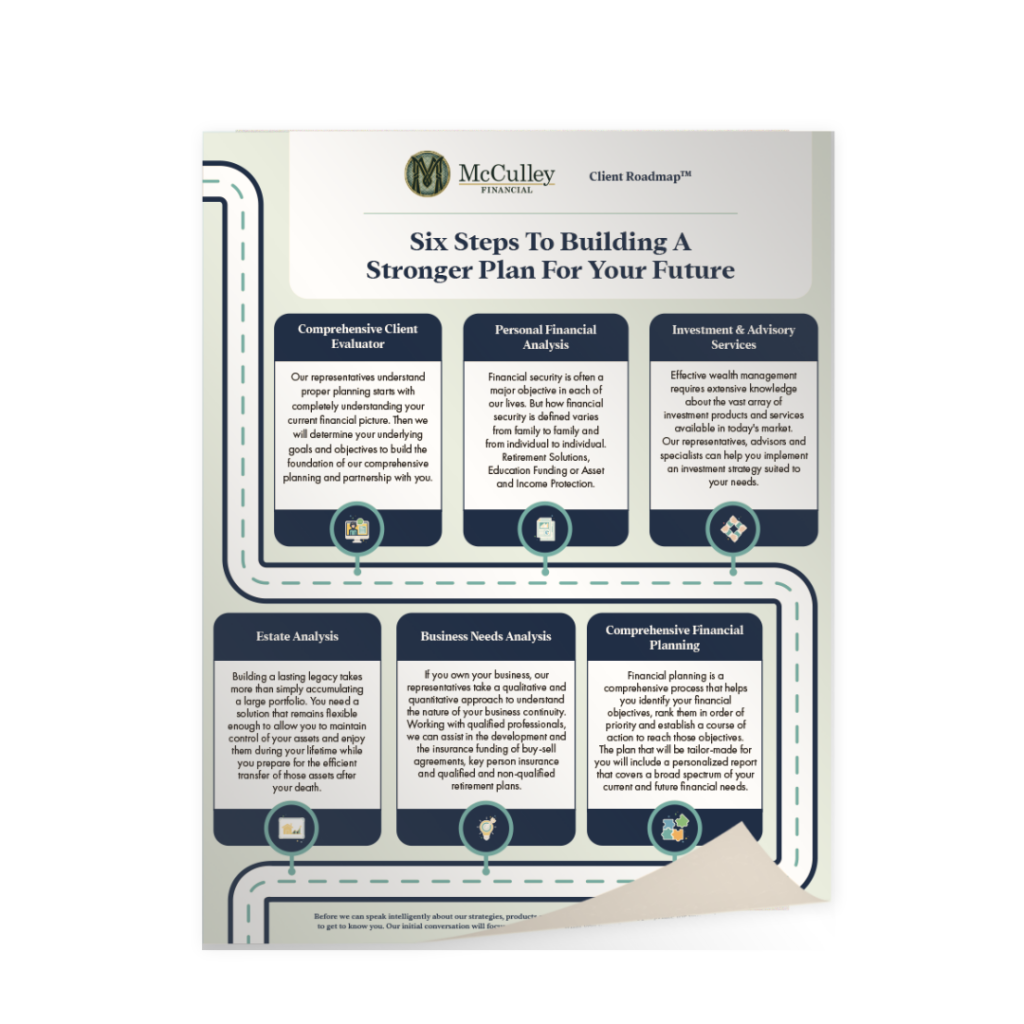

Download the Client Road Map™ PDF brochure below for a reference guide to our Financial Services.

A connected approach to your financial world

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.