- (866) 299-9944

- Mon → Fri: 9am - 5pm

- Email: insight@mcculleyfinancial.com

Simple Strategies for Boosting Knowledge and Skills through Employee Education in the Workplace.

Creating a supportive work environment involves helping employees learn and grow continuously. Employee education is more than just training—it’s about providing accessible opportunities for everyone to develop their skills. This can be through workshops, online courses, or mentorship programs. When organizations invest in their employees’ growth, it not only improves their professional abilities but also fosters a positive and motivated workplace. Recognizing and supporting the learning needs of employees helps build resilient, adaptable, and successful teams. Employee education becomes a vital aspect of creating a work environment that encourages continuous improvement and long-term success.

Get ready for group enrollment by sharing information and sparking excitement through pre-enrollment memos and announcements. Address common questions in advance, making participants feel well-prepared and eager to join the enrollment process. This helps create a positive and smooth experience for everyone involved.

Make enrollment hassle-free with our On-Site Group Enrollment. You can also schedule Individual Meetings at your convenience for a personalized experience. We’re here to simplify the process, ensuring flexibility and ease tailored to your schedule and needs.

At Group Investment Education Meetings, we aim to help participants understand how to wisely manage their contributions and distribute assets. Gain practical insights for confident decision-making, ensuring a secure financial future for everyone involved.

We can speak different languages to better assist diverse teams, ensuring everyone understands the enrollment process. This helps create a welcoming and inclusive experience, making sure information is clear for all our clients and their teams.

On-Demand Education brings you personalized, easy-to-follow learning modules available on the company intranet. Topics include Plan Basics, Asset Allocation, Pre-Retirement Planning, Loans, and Market Timing. Empower yourself at your own pace with accessible education designed to enhance your skills and knowledge.

Discover our Gap Analysis Program, designed to understand your lifestyle needs and offer clear retirement guidance. We help bridge gaps in your plans, creating a personalized roadmap for a secure and satisfying retirement that aligns with your goals. Plan your future confidently with our straightforward and supportive approach.

Explore our 401k services tailored for both individuals and businesses. We believe in simplifying retirement planning. Whether you’re new to investing or experienced, our approach is straightforward. We offer various options and personalized strategies to help you build a secure financial future. Our goal is to empower you to make informed decisions and achieve your retirement dreams.

We get what entrepreneurs need. Our support is personalized to tackle challenges and fuel growth. Simple, effective solutions for success.

Plan your money wisely with Comprehensive Financial Planning. Secure your future, grow wealth, and make smart investment choices for success.

Follow the best practices for managing money responsibly and ethically to build trust, be transparent, and achieve positive results for everyone.

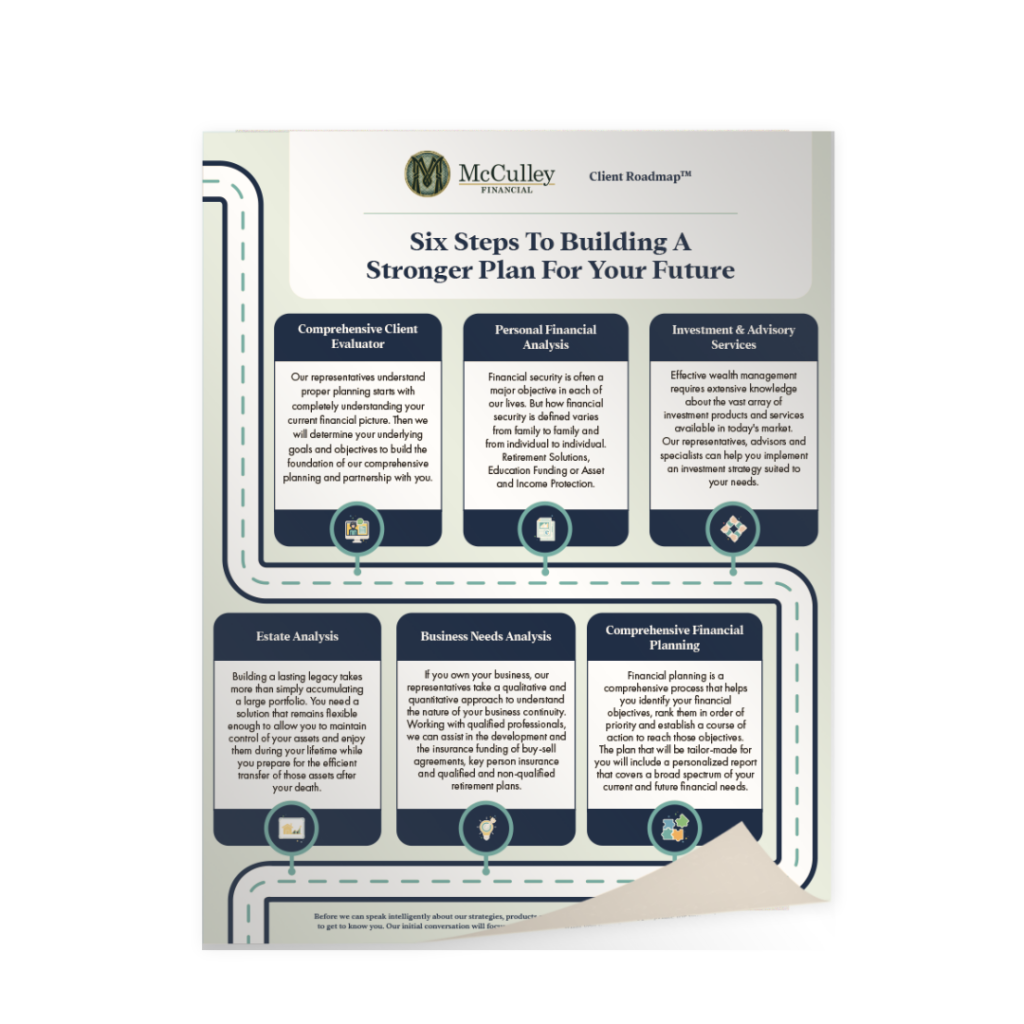

Download the Client Road Map™ PDF brochure below for a reference guide to our Financial Services.

Feel free to chat with us! We’re all ears and excited to hear from you.

©2024 McCulley Companies

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.