- (866) 299-9944

- Mon → Fri: 9am - 5pm

- Email: insight@mcculleyfinancial.com

Your Path to Financial Freedom and Brighter Tomorrows Begins Here!

Explore our Employer Services designed for your business. We offer straightforward solutions to support a thriving workplace. Our focus is on simplicity, efficiency, and dedicated assistance, ensuring your company experiences growth and success. Trust us to provide essential support in a manner that is accessible and easy to navigate.

Building a solid retirement plan starts with careful design and execution. Our method includes a thorough Fiduciary Check-Up Program and an annual Fiduciary Plan Review, offering practical insights to boost value and efficiency. Overlooking design details initially could lead to issues in investments, record-keeping, compliance, and communication down the road.

Discover how McCulley Financial Group actively supports clients by managing costs, expanding services, and optimizing investments through our innovative fee benchmarking process. We use a unique approach that combines numbers and insights for a thorough analysis. Regular meetings and site visits help us stay updated and ensure ongoing evaluation.

Experience the efficiency of McCulley Financial Group’s RFPs. Our simplified system grants easy access to provider data, helping assess fees, services, and investments for confident decisions. Trust us for seamless transitions and future financial confidence.

At MFG, we prioritize your financial well-being. Our approach involves careful analysis to guide responsible investment choices and enhance opportunities for you. Using our unbiased Fiduciary Scorecard System, we provide clear assistance in selecting, monitoring, and evaluating funds within a best practices framework. Your understanding grows because we’re committed to keeping you informed.

Our consultants are here to provide tailored recommendations backed by thorough statistical analysis. Going beyond typical investment reviews, we use advanced technology to rank and monitor various funds and strategies. With an unbiased research team, we deliver straightforward reports to guide your investment decisions wisely.

Choosing and assessing funds is a thorough process using more than 15 metrics. Our simple one to ten scoring system guarantees transparency in rankings. Stay well-informed with clear reports and monthly newsletters, ensuring confident investment decisions aligned with industry trends and legislative updates.

We specialize in helping businesses stay compliant with DOL, IRS, and other regulations. Our focus is on improving investment opportunities for plan participants. As your co-fiduciary, we handle the selection and monitoring of investments, providing compliance services like ERISA 404(a) and 404(c) to minimize risks and enhance your retirement plan.

At McCulley Financial, we are honored to support some of America’s most forward-thinking companies. Our clients appreciate the high level of service and performance they experience with us. We provide innovative solutions that prioritize your company’s peace of mind. Our services include Plan Design Analysis, Compliance Checklist, Investment Policy Statement, Fiduciary Plan Review, 404(c) Policy Statement and Notice, Custom Fee Disclosures, Fiduciary File Checklist, and 404(a) Monitoring. Let us bring clarity and assurance to your financial planning.

Explore our 401k services tailored for both individuals and businesses. We believe in simplifying retirement planning. Whether you’re new to investing or experienced, our approach is straightforward. We offer various options and personalized strategies to help you build a secure financial future. Our goal is to empower you to make informed decisions and achieve your retirement dreams.

We get what entrepreneurs need. Our support is personalized to tackle challenges and fuel growth. Simple, effective solutions for success.

Plan your money wisely with Comprehensive Financial Planning. Secure your future, grow wealth, and make smart investment choices for success.

Follow the best practices for managing money responsibly and ethically to build trust, be transparent, and achieve positive results for everyone.

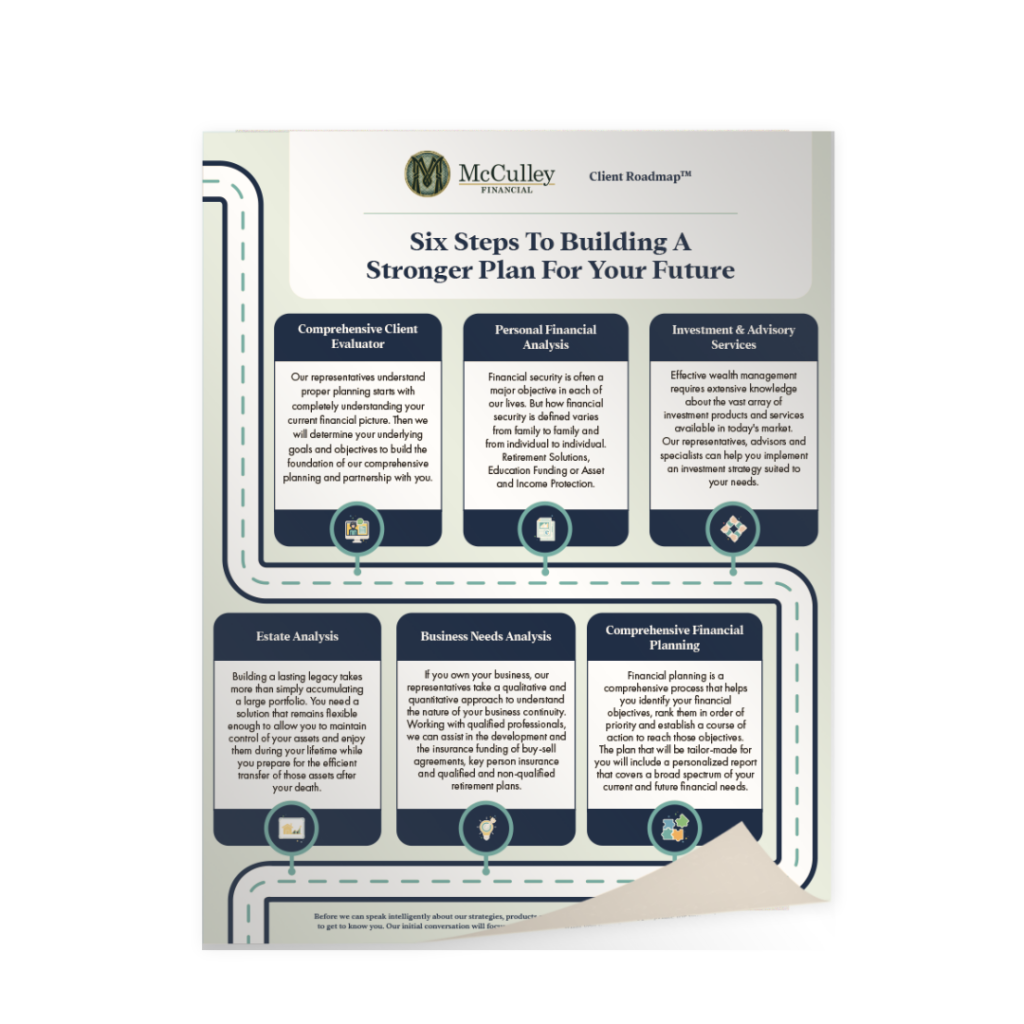

Download the Client Road Map™ PDF brochure below for a reference guide to our Financial Services.

Feel free to chat with us! We’re all ears and excited to hear from you.

©2024 McCulley Companies

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.