- (866) 299-9944

- Mon → Fri: 9am - 5pm

- Email: insight@mcculleyfinancial.com

Exploring Simple and Smart Retirement Options for Financial Security and Peace of Mind.

Crafting the perfect retirement plan is essential. At McCulley Financial Group, we acknowledge that effective planning starts with a tailored strategy. We recognize that every company is distinct, and so should be the retirement plan. Ensuring uniqueness in design, we guide you through personalized retirement plan options for a secure financial future.

A Defined Benefit Plan guarantees a specific monthly retirement payout based on factors like salary and service years. For example, it might calculate as 1 percent of the average salary over the last five years for each year of service. These plans are federally insured, within certain limits, through the Pension Benefit Guaranty Corporation (PBGC), providing added security to retirees. This ensures a reliable and secure financial support system for individuals post-retirement.

In a Defined Contribution Plan, retirement benefits aren’t predetermined. Instead, employees or employers contribute, often a fixed percentage, like 5% annually. These contributions are invested, and employees receive the account balance at retirement, including contributions and investment gains or losses. The account value fluctuates with investment changes. Examples of defined contribution plans are 401(k) plans, 403(b) plans, employee stock ownership plans, and profit-sharing plans.

A Simplified Employee Pension Plan (SEP) provides a straightforward way for employees to save for retirement. This uncomplicated plan allows employees to make contributions to individual retirement accounts (IRAs) with tax benefits. SEPs come with minimal reporting and disclosure requirements, making them an accessible option for both employers and employees. To participate, employees need to set up their IRAs to receive employer contributions. While Salary Reduction SEPs are no longer an option, employers can still establish SIMPLE IRA plans with salary reduction contributions. If a business previously had a salary reduction SEP, they have the option to continue allowing contributions to the plan. This flexibility ensures that employees can continue building their retirement savings within the framework of their employer-sponsored plans.

The SIMPLE IRA Plan (Savings Incentive Match Plan for Employees) lets both employees and employers contribute to individual retirement accounts. It’s ideal for small businesses without a retirement plan, offering a straightforward way to save for retirement. With lower start-up and operating costs compared to traditional plans, it’s a cost-effective option for businesses. This plan allows both employers and employees to set aside money for retirement, providing a practical and accessible means of building retirement income.

A Profit-Sharing Plan, also referred to as a Stock Bonus Plan, allows employers to decide on yearly contributions, typically derived from profits. This plan involves a method for distributing a portion of each annual contribution to individual participants. What makes it versatile is its flexibility and the potential integration with a 401(k) plan. This integration provides employees with an opportunity to save for retirement while aligning with the broader financial objectives of the company.

A 401(k) plan empowers employees to save a portion of their salary before taxes, often matched by employers. Simple rules, including contribution limits, apply. By contributing a part of their salary and sometimes overseeing their investments, employees play an active role in securing their retirement. It’s essential to grasp these straightforward concepts as individuals take charge of shaping their financial future.

An Employee Stock Ownership Plan (ESOP) is a retirement savings plan where investments primarily consist of employer stock. This setup encourages employee ownership, aligning their interests with the company’s success. Through contributions, employees not only gain financial benefits but also develop a stronger connection to the organization, fostering a sense of shared success.

Embark on the simplicity of the Money Purchase Pension Plan, where employers make steady contributions for stable retirement benefits. This straightforward approach ensures financial security for employees, making it an accessible and reliable option for employers seeking uncomplicated yet effective paths to support their workforce’s long-term well-being.

A Cash Balance Plan blends aspects of defined benefit and contribution plans. It outlines benefits using an account balance, incorporating annual employer-contributed “pay credits” and “interest credits.” Unlike traditional plans, investment fluctuations don’t directly affect participant benefits, shifting risks to the employer. Upon qualification for benefits, participants receive a specified account balance. Federal insurance through the Pension Benefit Guaranty Corporation safeguards these benefits, ensuring financial security within set limits.

McCulley is dedicated to creating personalized solutions for Non-Qualified Deferred Compensation Plans (NQDC). Keeping your goals in mind, we assist plan sponsors in making well-informed decisions regarding executive benefits. Trust us to thoroughly examine existing plans, pinpointing areas for improvement. We start by comparing with industry standards, analyzing finances, and assessing funding options for a strong plan foundation. After implementation, our commitment continues with proactive management and ongoing adjustments to ensure your NQDC plan remains relevant and effective.

Explore our 401k services tailored for both individuals and businesses. We believe in simplifying retirement planning. Whether you’re new to investing or experienced, our approach is straightforward. We offer various options and personalized strategies to help you build a secure financial future. Our goal is to empower you to make informed decisions and achieve your retirement dreams.

We get what entrepreneurs need. Our support is personalized to tackle challenges and fuel growth. Simple, effective solutions for success.

Plan your money wisely with Comprehensive Financial Planning. Secure your future, grow wealth, and make smart investment choices for success.

Follow the best practices for managing money responsibly and ethically to build trust, be transparent, and achieve positive results for everyone.

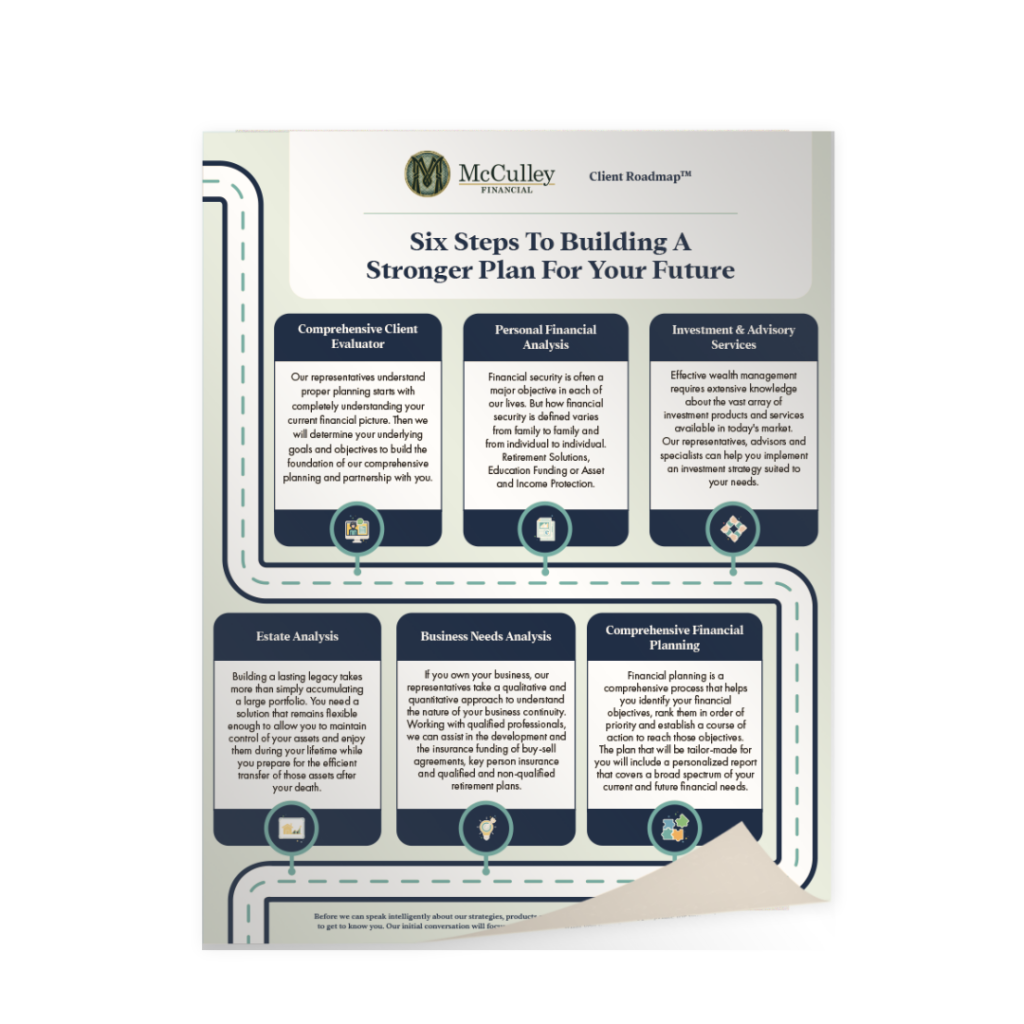

Download the Client Road Map™ PDF brochure below for a reference guide to our Financial Services.

Feel free to chat with us! We’re all ears and excited to hear from you.

©2024 McCulley Companies

Protect your assets by applying several layers of protection. This can take the form of liability insurance, fundamental practices, and other smart strategies.

A solid asset protection plan means you no longer have to feel at risk of losing everything due to litigation or unforeseen events.

Get affordable coverage that aligns with your company’s needs – no matter how unique your needs are.

Our team helps you navigate complex insurance-related issues, risk management, and employee benefit issues so you can be safeguarded against any type of risk.

Gain access to a wide array of products and services that will ensure we make the right choices to grow your portfolio.

Our fee-based consulting means our only focus is doing what’s right to build your wealth – not earning a commission.

Our risk-averse approach coupled with our extensive investment analysis means we can build a portfolio that maximizes return while minimizing risk.

We identify your objectives and needs to design a realistic, actionable plan you can fully understand.

Whether you’re saving for a house, paying for an education, or want to ensure you have enough for retirement, we make it possible.

We can also help business owners gain additional life, health, and retirement benefits beyond the basic employee scope.

Explore a wide range of solutions and get a custom designed plan that helps employees reach their retirement goals.

Participants also have access to one-on-one personalized education to help them navigate the complexities of their plan so they can feel confident in their choices and future.

Get the right strategy and tools to maximize your savings. As a self-employed entrepreneur, you’ll discover new opportunities to grow your nest egg faster – which includes identifying opportunities to shelter assets from taxes or reduce your tax liability.

Experience the peace of mind that comes with being able to maintain your lifestyle through retirement, stay prepared for the unexpected, and leave a legacy for loved ones.